Investors Praise Apple's 'quality' And 'reliability' In Volatile Times

After a challenging 2022 in which the Nasdaq Composite fell more than 33% amid aggressive interest rate hikes, the outlook for the technology sector has changed significantly in favor of the bulls.

The Nasdaq is currently the top-performing major U.S. index for the year, up 9.7% so far.

But with the persistently high inflation and the enduring resilience of the American consumer, the path of interest rate hikes is unpredictable, and investors continue to worry about a possible recession.

In light of this, tech investor Mark Hawtin thinks that Apple would be a safer investment inside the mega-cap market.

"In my opinion, the fate for Apple largely relies on the perspective you hold toward the macro. Apple, in my opinion, is still a solid stock to hold if the macroeconomic climate is uncertain since it offers stability in a volatile market. Within those big size equities, it's the sort of high-quality, slow-growth but dependable name, according to Hawtin, investment director at GAM Investments, who spoke with Trade Algo.

Apple released its Christmas quarter financial results earlier this month, but many of its business divisions fell short of Wall Street's revenue, profit, and sales projections. That was the IT giant's first earnings shortfall in nearly seven years, a rare occurrence.

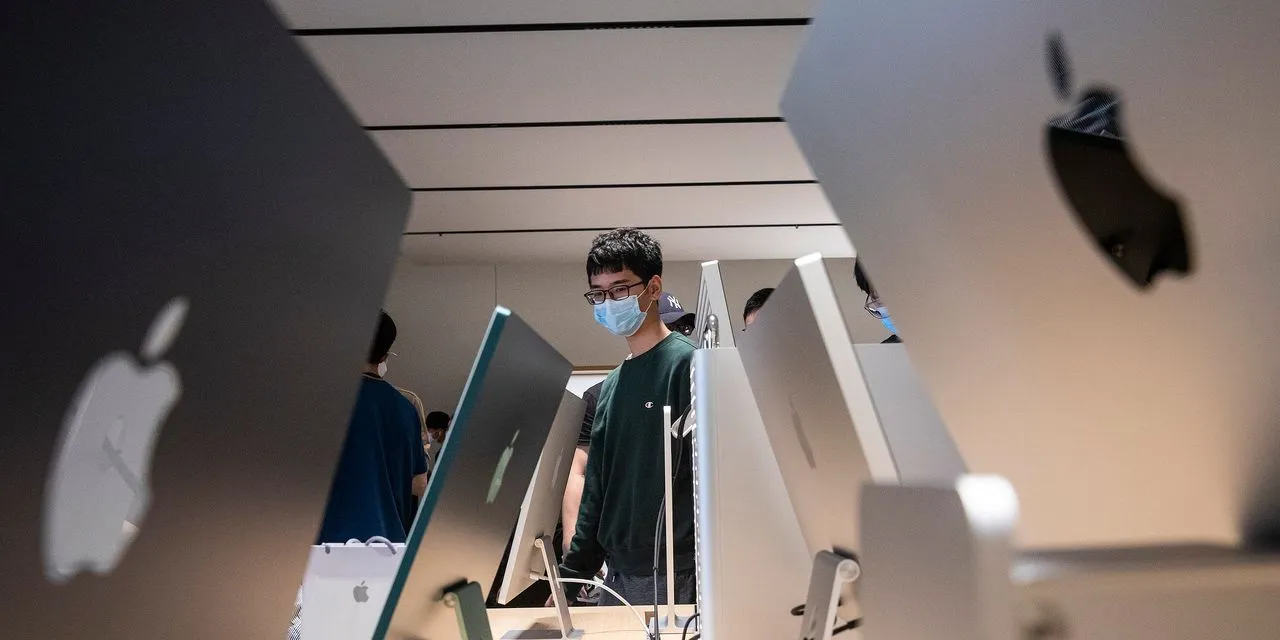

Due to the Covid-caused shutdown of a crucial Chinese assembly plant, fewer iPhone 14 Pro and iPhone 14 Max models were available for purchase, which was a result of Apple's well-known supply chain issues.

But, production is once again at levels that the business is happy with, according to Apple CEO Tim Cook.

"I believe [Apple] will always succeed in overcoming supply chain challenges. A huge corporation. It holds a position of great dominance. It is quite effective at protecting its supply chain. So I'm not concerned about that," Hawtin remarked.

A Berkshire staple

Apple is the largest wager among Berkshire Hathaway's disclosed holdings, and Warren Buffett is a lover of the company as well. According to a regulatory filing, Berkshire increased its investment in Apple to 5.8% last quarter by purchasing an additional 20.8 million shares for $3.2 billion.

With Apple stock up around 18% this year, Berkshire's decision seems to have paid off. With a "buy" rating from 78% of analysts who cover the stock and an average upside of 15%, analysts believe the stock will rise.

Subscribe to our newsletter!

As a leading independent research provider, TradeAlgo keeps you connected from anywhere.